Just How Livestock Threat Protection (LRP) Insurance Policy Can Secure Your Animals Investment

Livestock Threat Protection (LRP) insurance coverage stands as a dependable guard against the uncertain nature of the market, providing a tactical strategy to securing your assets. By diving into the details of LRP insurance coverage and its complex benefits, livestock manufacturers can strengthen their investments with a layer of protection that transcends market changes.

Comprehending Livestock Risk Defense (LRP) Insurance Coverage

Understanding Animals Danger Protection (LRP) Insurance coverage is necessary for livestock producers wanting to reduce economic risks connected with price changes. LRP is a government subsidized insurance coverage product created to safeguard manufacturers against a decline in market costs. By giving protection for market price decreases, LRP helps producers secure in a floor price for their animals, making certain a minimum degree of income regardless of market fluctuations.

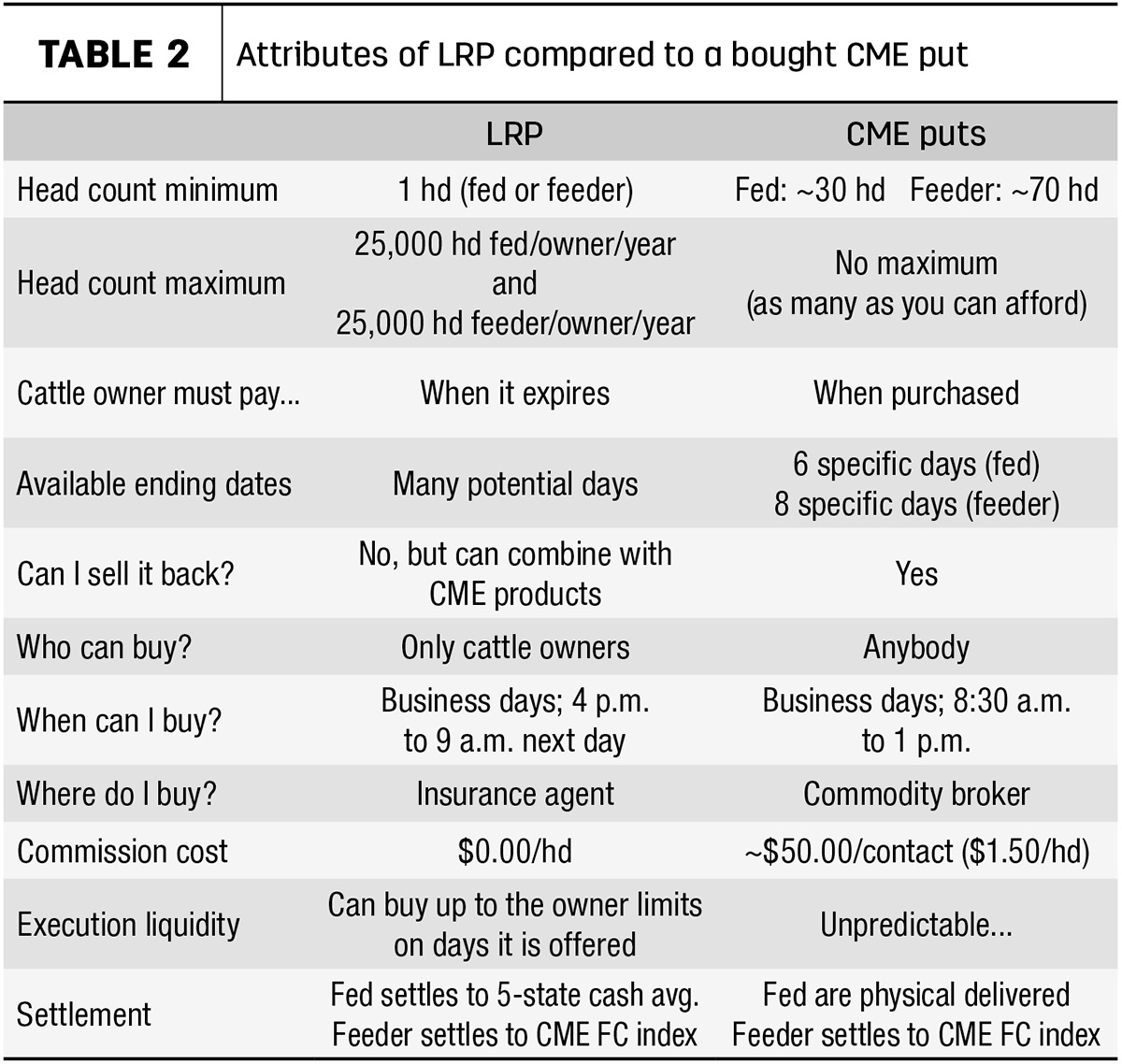

One secret element of LRP is its flexibility, permitting producers to tailor protection levels and plan lengths to fit their specific requirements. Producers can select the variety of head, weight array, coverage cost, and protection period that align with their production objectives and run the risk of tolerance. Comprehending these personalized alternatives is essential for manufacturers to properly handle their price danger direct exposure.

Furthermore, LRP is readily available for numerous livestock kinds, including livestock, swine, and lamb, making it a versatile threat monitoring tool for livestock manufacturers across various fields. Bagley Risk Management. By familiarizing themselves with the details of LRP, producers can make informed decisions to guard their investments and guarantee financial security in the face of market unpredictabilities

Advantages of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Livestock Risk Security (LRP) Insurance obtain a critical benefit in protecting their investments from rate volatility and safeguarding a secure economic footing in the middle of market uncertainties. By establishing a floor on the price of their animals, manufacturers can reduce the risk of significant economic losses in the event of market recessions.

Furthermore, LRP Insurance coverage offers producers with peace of mind. Generally, the benefits of LRP Insurance coverage for livestock producers are significant, supplying a beneficial device for taking care of danger and making sure monetary safety and security in an unpredictable market atmosphere.

Just How LRP Insurance Mitigates Market Risks

Alleviating market dangers, Livestock Risk Protection (LRP) Insurance gives animals manufacturers with a trustworthy guard versus cost volatility and monetary uncertainties. By providing protection against unexpected price declines, LRP Insurance policy aids manufacturers protect their financial investments and maintain economic security when faced with market fluctuations. This sort of insurance coverage enables livestock manufacturers to secure a cost for their animals at the start of the policy duration, making sure a minimal price degree no matter market adjustments.

Steps to Safeguard Your Livestock Investment With LRP

In the world of agricultural threat management, carrying out Animals Threat Protection (LRP) Insurance policy entails a calculated procedure to guard investments against market fluctuations and uncertainties. To secure your animals financial investment efficiently with LRP, the initial step is to examine the particular threats your procedure deals with, such as rate volatility or unanticipated climate occasions. Understanding these dangers allows you to figure out the coverage level needed to protect your investment sufficiently. Next, it is essential to research and pick a trusted insurance provider that supplies LRP policies customized to your livestock and business demands. When you have selected a service provider, carefully assess the policy terms, conditions, and protection limitations to ensure they line up with your danger management goals. In addition, consistently monitoring market fads and adjusting your insurance coverage as required can assist enhance your defense versus prospective losses. By following these actions faithfully, you can boost the safety and security of your animals check this site out investment and browse market unpredictabilities with confidence.

Long-Term Financial Safety And Security With LRP Insurance

Guaranteeing sustaining financial stability through the usage of Livestock Danger Defense (LRP) Insurance coverage is a sensible long-lasting approach for agricultural producers. By including LRP Insurance right into their risk management plans, farmers can protect their livestock investments versus unpredicted market fluctuations and unfavorable occasions that might endanger their financial health in time.

One key benefit of LRP Insurance for lasting monetary safety is the comfort it provides. With a reliable insurance coverage policy in area, farmers can minimize the financial risks connected with unstable market conditions and unexpected losses due to factors such as illness episodes or all-natural calamities - Bagley Risk Management. This security permits manufacturers to concentrate on the daily procedures of their animals organization without constant fear concerning prospective financial troubles

Moreover, LRP Insurance policy provides a structured strategy to managing risk over the long term. By setting specific insurance coverage degrees and picking proper recommendation periods, farmers can tailor their insurance coverage intends to align with their financial objectives and run the risk of resistance, guaranteeing a lasting and protected future for their animals procedures. Finally, buying LRP Insurance policy is a proactive method for farming producers to accomplish enduring economic safety and security and secure their resources.

Conclusion

In final thought, Animals Risk Protection (LRP) Insurance coverage is a useful device for livestock producers to alleviate market risks and secure their financial investments. By understanding the benefits of LRP insurance policy and taking steps to apply it, producers can attain long-term economic safety and security for their procedures. LRP insurance coverage offers a security web versus rate changes my review here and ensures a level of security in an uncertain market setting. It is a smart choice for protecting animals financial investments.